Renters Insurance in and around Westminster

Renters of Westminster, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

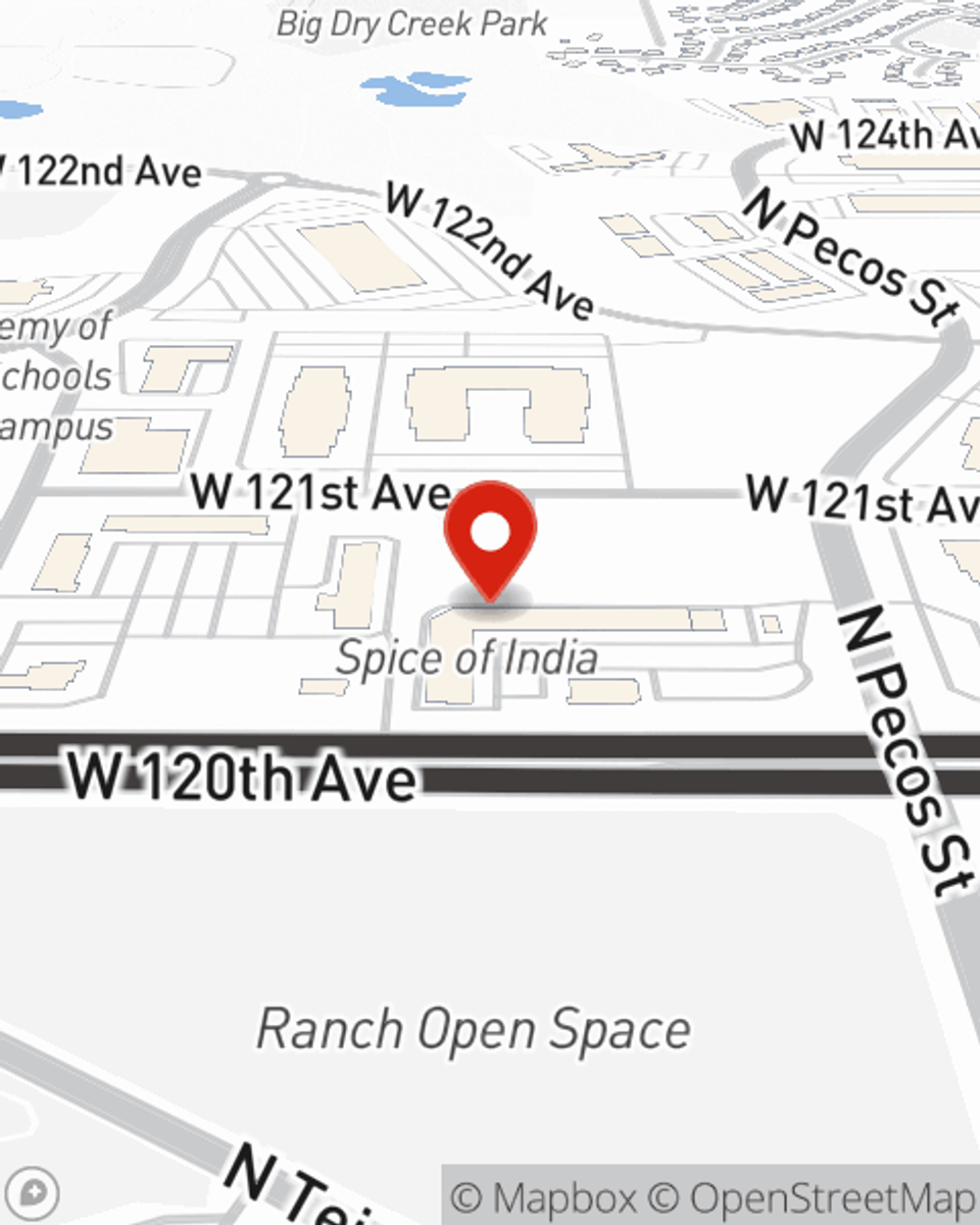

- Westminster

- Broomfield

- Denver

- Thornton

- BRIGHTON

- Louisville

- Lafayette

- Northglenn

- Superior

- Erie

- Boulder

- Arvada

Protecting What You Own In Your Rental Home

It may feel like a lot to think through your busy schedule, your sand volleyball league, keeping up with friends, as well as deductibles and providers for renters insurance. State Farm offers straightforward assistance and impressive coverage for your appliances, souvenirs and sports equipment in your rented house. When trouble knocks on your door, State Farm can help.

Renters of Westminster, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

Renters often raise the question: Do you really need renters insurance? Just pause to consider the cost of replacing your possessions, or even just a few high-cost things. With a State Farm renters policy in your pocket, you won't be slowed down by windstorms or tornadoes. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've secured in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Skyler Peak can help you add identity theft coverage with monitoring alerts and providing support.

If you're looking for a value-driven provider that offers a free quote on a renters policy, contact State Farm agent Skyler Peak today.

Have More Questions About Renters Insurance?

Call Skyler at (720) 287-0950 or visit our FAQ page.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Skyler Peak

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.